How to estimate market potential to effectively assess the viability of a new location

Opening a new store is a delicate process that requires careful execution—and even more careful planning.

Before you launch a new location into uncharted territory, it’s critical to estimate the potential of that local market. Doing so will help you assess the viability of an opening and determine whether it’s worth the risk, whether you are setting up a business or developing your brand.

In this step-by-step guide, the Symaps team will be sharing how companies estimate the market potential of potential locations and optimize their commercial strategy.

What is market potential of a location or a zone?

Market potential refers to the maximum sales volume that a company can expect to achieve in a given market if everything goes according to plan.

In the context of expansion planning, market potential is used to determine whether it’s worth expanding into a new geographic area based on the company’s business objectives (e.g., increasing market share or sales revenue).

There are a range of factors that can impact the market potential of an expansion location, including demographics, socioeconomic trends, footfall, infrastructure, internal & external competition. Collectively, these factors are known as “geomarketing data” – location-specific data that can help you understand said location’s market’s potential.

By using geomarketing data in their market research to estimate market potential, companies can get a better understanding of the risks and opportunities involved in expanding into new markets.

How? Let’s discuss.

How to use geomarketing data to estimate market potential

Using geomarketing data to estimate market potential is a four-step process:

1. Identify Relevant Data Categories

3. Identify Potential Locations

4. Evaluate Potential Locations

Let’s take a closer look at each step!

1. Identify Relevant Data Categories

In order to identify which data categories are relevant to your expansion efforts, you need to understand what makes your current location(s) successful.

If you’re opening your first business location, this step is still relevant. The key difference is that you’ll be trying to figure out what makes your competitors’ locations successful.

Is it the amount of footfall the area gets? Is it the demographic makeup of the surrounding area? Is it the presence (or lack) of competition?

Once you’ve determined which factors are driving sales at your current location(s), you can start to identify which data categories will be relevant to your expansion planning. For example, if you’re looking to expand your restaurant into a new city, some relevant data categories to study the new zone may include:

– Population Density

– Median Income Level

– Footfall

Uncover which factors may be driving the success of your current locations and segment your touchpoints according to their geomarketing profiles with Symaps location intelligence platform.

2. Identify Data Sources

Identifying relevant data categories is only half the battle – you also need to identify the right data sources so that you can benchmark potential locations. There are a number of ways to source geomarketing data manually, including national censuses, industry reports, and third-party data providers.

There are two problems with the manual approach, though:

1. It’s rare finding data sources that are comprehensive. That means you’ll probably be spending hours spent finding and piecing together multiple sources into something useful.

2. It’s even rarer to find data sources that are highly targeted. This is important because you’ll likely need to evaluate two locations that relatively close together (say, within the same neighborhood).

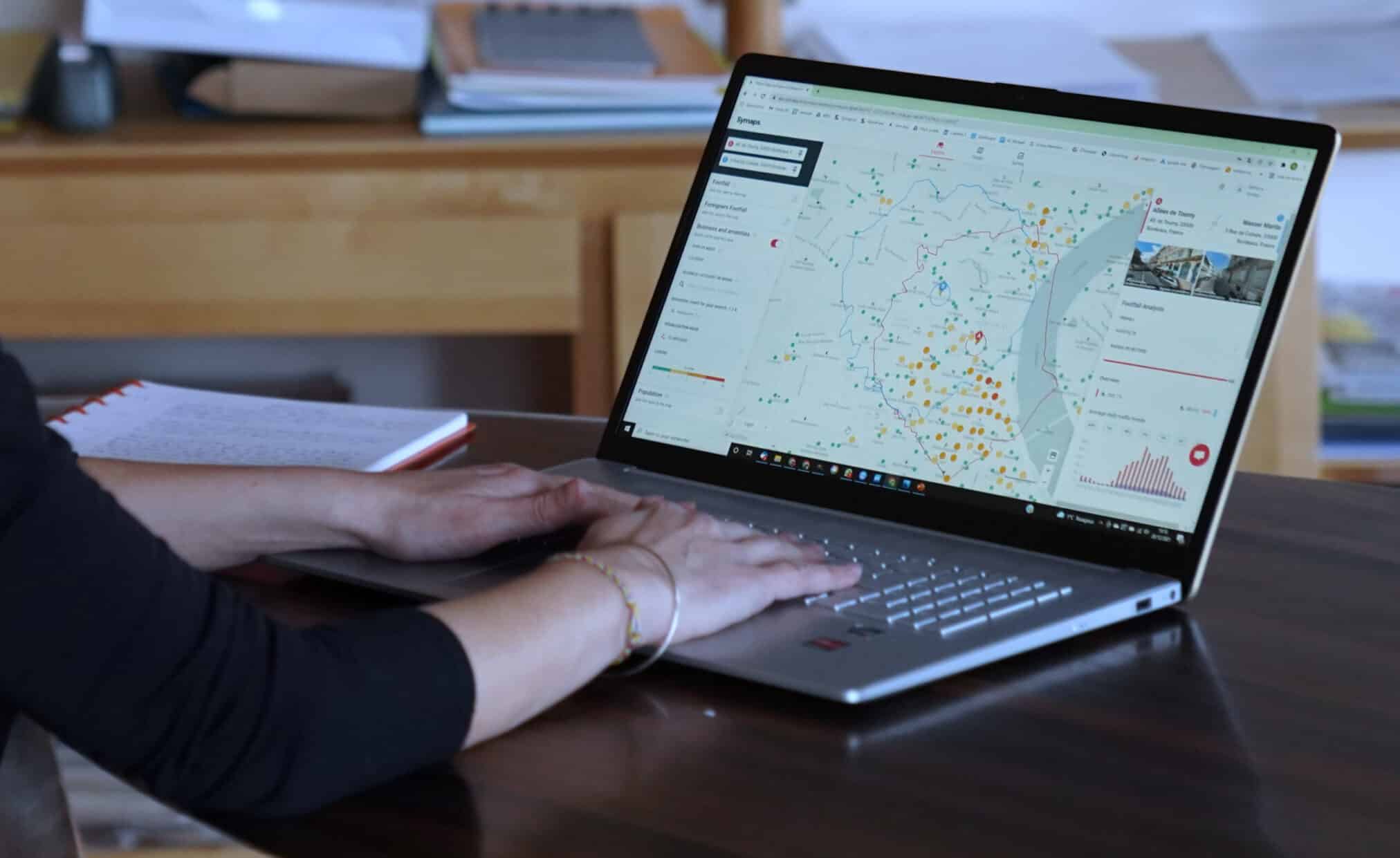

Geomarketing tools like Symaps location intelligence platform solve both of these problems by consolidating a massive range of reliable data sources and targeting it to a street-by-street level. You have access for instance to demographic data, business and ameninities in the zone, footfall, and more—for any address you’re considering.

Example:

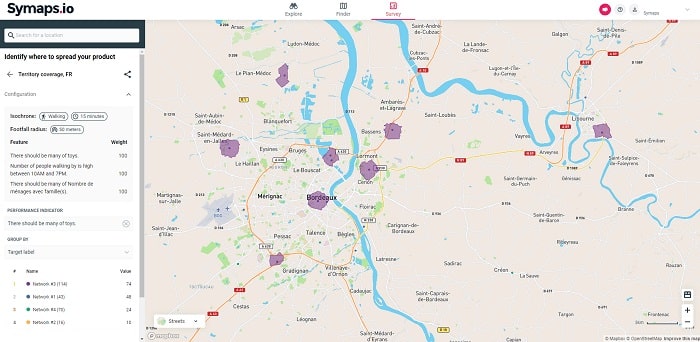

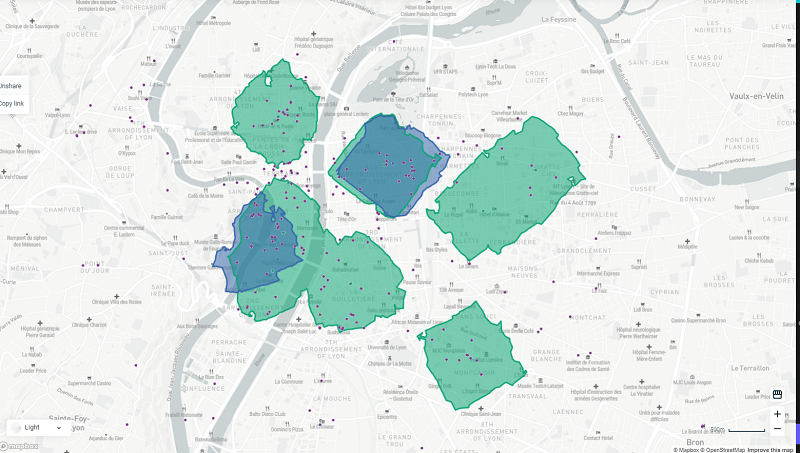

Determination of the primary, secondary and tertiary catchment areas by travel time around an address.

Example:

Segmentation and targeting of potential customers by socio-demographic profile (families without children with median income).

Speaking of locations…

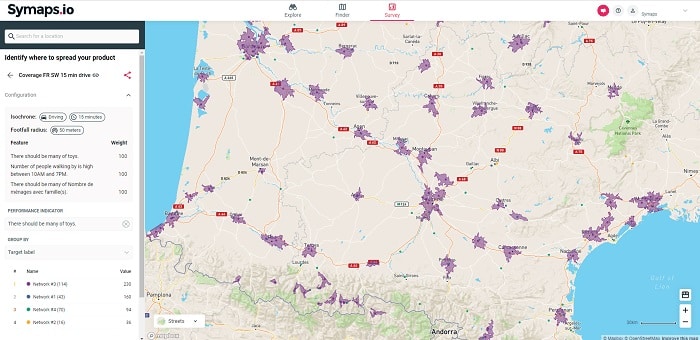

3. Identify Potential Locations

Now that you know which data categories are relevant to your expansion efforts and where to source that data, it’s time to start identifying potential locations. The goal here is to generate a shortlist of candidate locations that meet the requirements you identified earlier.

As you start this process, slowly shrink your search area hierarchically—international, national, regional, city, postcode, neighborhood, street—until you have a list of viable options. Using a geomarketing application at this stage will save you time and give you detailed insights on possible new areas for growth.

Some factors you may want to consider when identifying potential locations include:

– Proximity to Current Locations: It may make sense to open up shop in a city that’s relatively close to your current base of operations. This will make it easier to transfer existing processes, procedures, and (most importantly) people.

– Target Market: There’s no point in expanding into a new location if there’s no one there who’s interested in your product or service.

– Competition: Too little competition is often as damaging as too much.

– Footfall: One of the most important factors to consider when expanding into a new location is footfall.

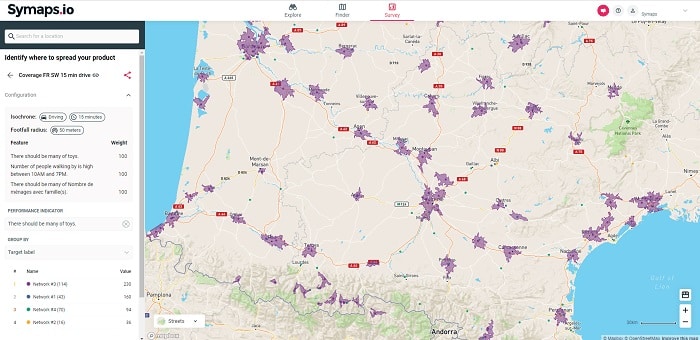

Identifying potential locations with Symaps location intelligence platform

Symaps allows you to define your target market based on a wide range of criteria (including age, gender, income level, and more) so you can visualize your network of locations and quickly identify nearby sites that make sense for expansion.

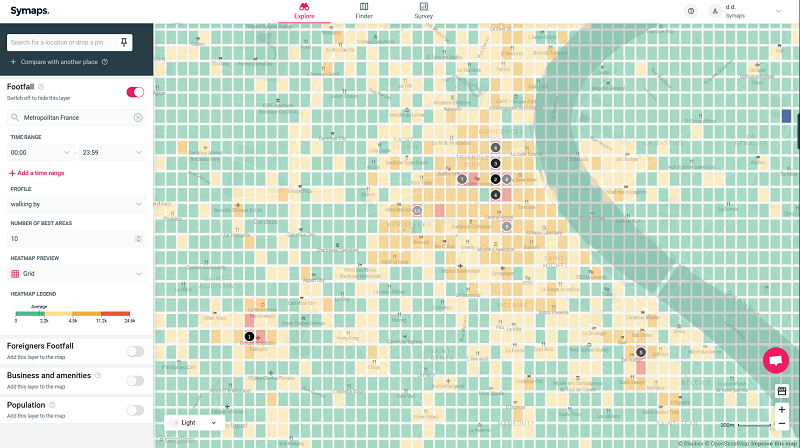

You can for instance quickly and easily assess the level of competition in any given area by displaying the coverage of your competitors. Detailed footfall heatmaps will also help you to get a sense of how many people are passing by potential locations on a daily basis.

Symaps goes beyond most geomarketing tools by allowing businesses to filter potential locations according to advanced, custom criteria that are actually relevant to them. If you own a fast-food restaurant that earns a large percentage of its revenue serving late-night food, you can filter for locations that see high footfall between 9PM and 1AM. If you’re expanding your network of high-end leisure boutiques, you can filter for locations in areas with a large population of active residents and a high median income.

The possibilities are endless.

4. Evaluate Potential Locations

Once you’ve generated a shortlist of potential locations, it’s time to start evaluating them. The goal here is to use the data you’ve collected to identify the location that presents the best opportunity for success.

The first step is to create a business plan that estimates your future activity and projected turnover. These projections will be more accurate if the previous steps have been executed carefully.

In concrete terms, the analysis of geomarketing data of the potential locations should make it possible to answer the following questions.

Is the revenue model adapted to this location?

This point may vary based on industry and sector. For example, a restaurant chain will need to determine the proportion of its revenue that comes from each of its channels: in-store, takeaway, and delivery. One location may be a better fit for one channel over another. On the other hand, a retailer will need to ensure that the opening of a new location fits within its broader, omnichannel strategy.

What is the size of the market? How many target customers can the location serve?

What market share should you target?

Depending on the competitive pressure in the area, this share can vary greatly and impact your forecast models. For example, an area where supermarkets have sizable book isles may not be ideal for a bookshop location.

This data will allow you to make an initial estimate of the number of potential customers in your catchment area.

To estimate your potential customer base, you can plug data from your geomarketing research or tool into the following equation

(Size of target population) x (Market share) = Size of potential customer base

What is the average lifetime value of your target customers?

The level of spending by your future customers, as well as their loyalty and repeat visits, will vary according to the demographic profile of the population in the vicinity, even for the same brand. It is therefore essential to check that the spending projections are in line with the purchasing power and profile of your future customers!

What is the frequency of visits and revisits?

How many times a day, week, month, or year will your target customers visit and revisit the location? Does your business primarily rely on regular customers or new customers?

Answering these questions is key for assessing potential locations based on factors like tourism or revisit frequency.

(Size of potential customer base) x (Average basket) x (Number of visits/month) = Potential monthly turnover

These estimates should be set against the costs of the new location (rent, works, etc.). Is a higher rent justified for a geographical area?

Depending on the criteria most relevant to your business model and sector of activity, refine the revenue and profitability projections for a given location.

Commercial potential: using an effective geomarketing tool

Competitive pressure is increasing across all industries and sectors. More and more retailers and small businesses are using geomarketing tools to help them measure the market potential of potential (and existing) locations.

Symaps location intelligence platform allows you to find the locations that meet your requirements and also to rank them according to how well they meet your criteria.

The platform also makes it easy to run side-by-side comparisons of potential locations. Just choose two addresses, and you’ll be able to see how they stack up against each other across a range of criteria, including:

– catchment area

– median income level

– population density

– foot traffic

And more!

This comparison helps you compare the market potential of both locations, so you can make an informed decision about which one is the best fit for your business.

It’s time to make your move!

Once you’ve selected the perfect location for your expansion, it’s time to make your move!

Of course, actually opening up shop in a new location is a huge undertaking—one that requires careful planning and execution. But with the right tools in place, you can be sure that your expansion efforts will be successful.

Symaps is the perfect tool for businesses of all sizes who are looking to expand into new markets. With Symaps, you have everything you need to identify potential locations, evaluate their market potential, and make an informed decision about where to open up shop.

And the utility doesn’t stop once you’ve found your new location. You can use Symaps geomarketing data to create theoretical performance benchmarks for all existing your locations. Armed with these benchmarks, you can quickly zero in on problems and inefficiencies, so your network is always performing optimally.

Want to see the benefits for yourself? Schedule a demo of Symaps today!

Going Further

In addition to the location study, calculating the “theoretical” commercial potential of an existing outlet also makes it possible to monitor commercial efficiency, to implement targeted commercial actions (to build loyalty among existing customers, for example) or to identify operational growth levers.

This will enable the implementation of targeted action plans in line with the retailer’s commercial policy.

Share post