Territorial network: optimize your sales outlets network

What is territorial network ?

Territorial network: definition

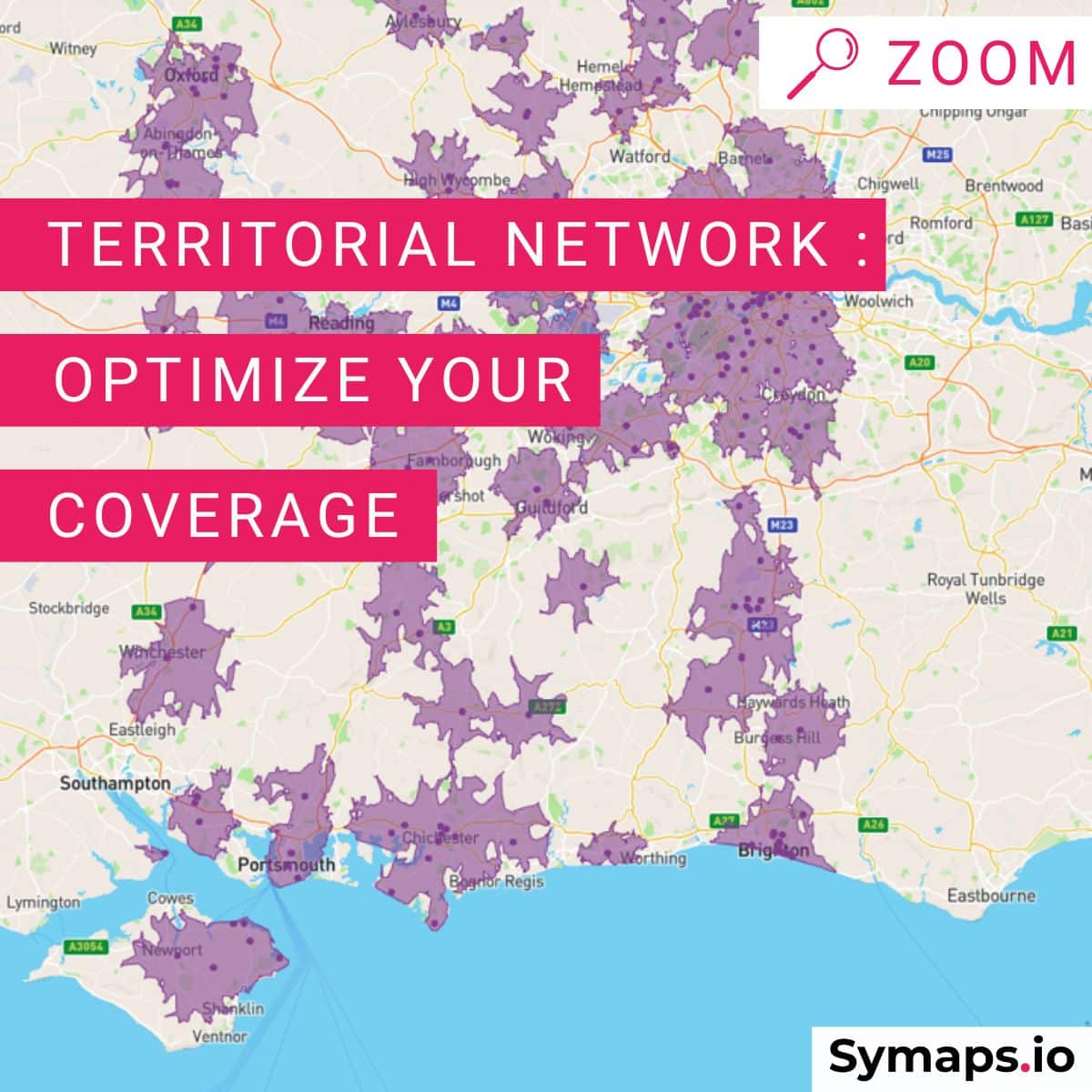

Territorial network helps identified the way in which a network of sales outlets (franchises or sales outlets of the same brand) covers a given area.

The study of the territorial network is done through a territorial network plan.

It is the compass that is used to develop its strategy of expansion and to prospect for new locations.

Zoning or Sectorization Research

You may also have heard of a zoning or sectorization research.

These terms describe the mapping of a given territory with the catchment areas of a company’s current and future sales outlets, which makes it possible for the company to establish its territorial network plan.

What’s the purpose of the territorial network plan ?

The territorial network plan is a decision-making tool to ensure an optimized coverage of a retailer’s network of sales outlets in a given territory.

The territorial network plan enables to:

✓ define its expansion and growth strategy on the given territory

✓ avoid failures by setting up in the right places

✓ optimize the coverage of its network

✓ define the priority areas of establishment

✓ control its development costs and choice of location

✓ define areas with equivalent potential, which is particularly useful for franchisors to suggest sufficiently efficient areas to their franchisee candidates.

How to build a good territorial network?

Identifying the success criteria of your project

The first step is to establish the ideal location profile, the one that really resonates with your concept.

Several profiles can be defined, depending on the type of your sales outlets.

For this purpose, it will be useful to rely on the knowledge and analysis of existing sales outlets.

In the context of a franchise, for example, an in-depth study of the pilot units will allow you to identify the success criteria for replicating the concept on a larger scale.

At this stage, an analysis of the coverage of direct competitors can also be useful to give valuable indications on the type of locations to favor.

The main questions that arise when deciding on a new location should be answered as precisely as possible:

– Which socio-demographic profiles should be targeted first?

– Does the population in the vicinity correspond to the brand’s target?

– What is the minimum traffic that the location should have? during the day? during the week? during the weekend?

– What is the pedestrian and car traffic in the vicinity?

– Are there any shops or facilities in the vicinity that generate traffic?

– What is the competitive environment?

– What facilities and infrastructures are nearby?

This step is essential because it will allow us to establish and prioritize the criteria for future locations.

Establish a consistent network of zones in the territory

Once the ideal profile(s) have been established, it is time to see how best to replicate these location criteria to ensure the profitability of new sales outlets.

1. Mapping the Existent Network

First, we can display the existing network and its catchment areas.

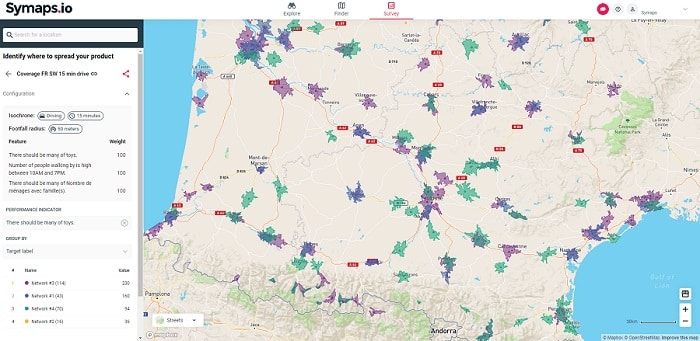

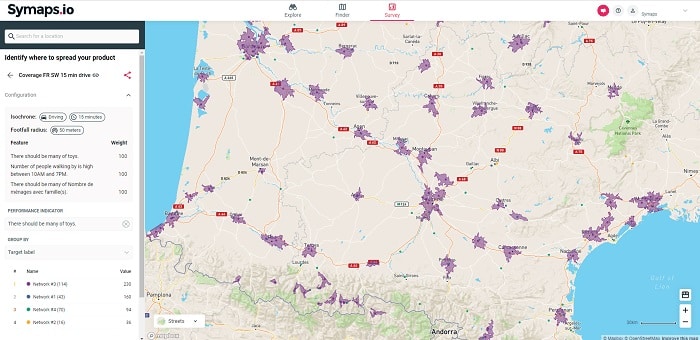

2. Characterization and prioritization of new zones

Using the criteria established in the previous step, we can identify the areas of interest that meet the required criteria and determine the priorities for implementation.

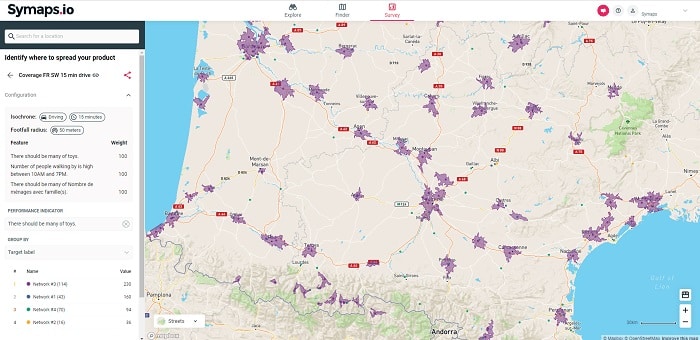

The study and ranking of the areas considered can be done at the national level, by region, by area or by type of location (medium-sized cities, outlying areas, city centers, rural areas…). We can also estimate the number of sales outlets to be opened to cover an area.

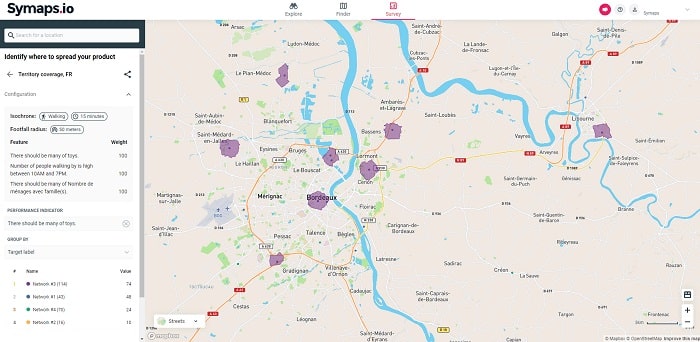

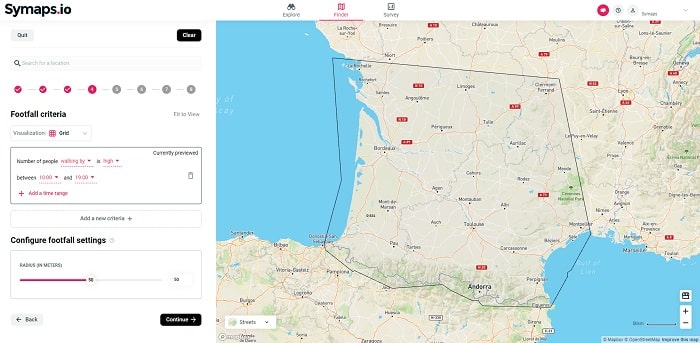

A smart location intelligence tool like Symaps not only identifies locations that replicate the success factors established by the brand, but also ranks them according to their potential.

3. Check consistency of the areas

By analyzing potential growth areas with a smart geo-location application like Symaps, the new areas identified will be ranked according to how well they match the criteria requested.

Socio-demographic data, competitive pressure, and the number of visitors in the area are integrated from the start.

Once the areas of priority interest have been selected, the analysis can be continued to ensure that they are consistent in terms of size and potential, among other things.

Taking into account the specific elements related to the situation of each zone considered may thus lead to readjustments (geographical situation, specific development of the territory, urbanization, local weight of competition, etc.).

Territorial network and zoning research: which tools to use?

The use of geomarketing tools has become essential to make a territorial network plan and zoning research.

Advantages:

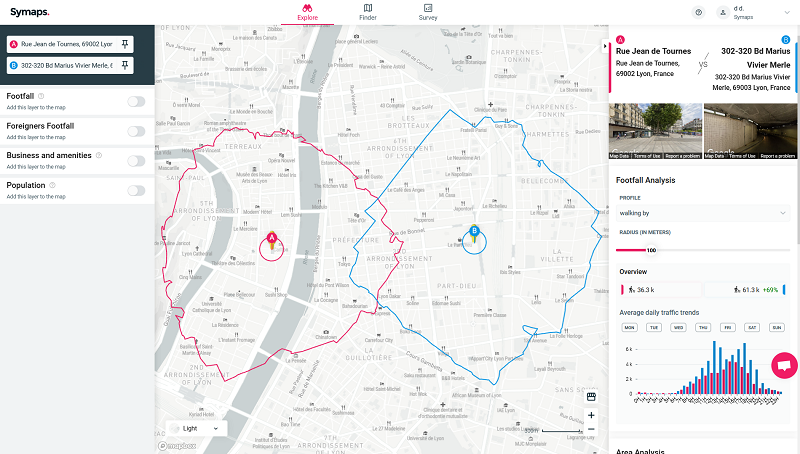

– Immediate access to data related to an address and a territory: socio-demographic data, competitive environment, nearby facilities.

– Pedestrian and car traffic to estimate the number of visitors in a zone.

– Quick and easy visualization on an interactive map.

– Identification and classification of new areas and their potential according to success criteria.

Symaps’ geomarketing platform enables the smart geolocation of locations to establish an efficient territorial network plan.

By combining pedestrian/car traffic data with other geolocation data such as the profile of the nearby population, it is possible to establish homogeneous and viable zones with a coherent distribution on the territory.

Going Further : combine customers and stores data with geodata

For existing networks, it is possible to refine projections by combining historical data on the performance of sales outlets or anonymized customer data with geolocation data.

Symaps’ geographic smart platform enables data enrichment to accurately estimate the potential of each area.

Territorial Network: When is it possible to make zoning research?

At start-up

The territorial coverage plan must be established as soon as a network is launched.

It allows to foresee a coherent growth on the territory, to ensure a control of the development costs and the viability of the new openings.

The territorial network plan is not a legal obligation, unlike the local market report or the DIP which is mandatory for franchisors.

However, it is essential for framing the development plans of a brand. It is also a useful tool for convincing prospective franchisees to join the network.

Constant evaluation, every 3 to 5 years

Once the territorial network plan has been defined, it is important to regularly monitor the territory and the evolution of the network. A constant evaluation every 3 to 5 years will allow you to take into account changes in your network of sales outlets and franchisees, the openings and closings of your competitors, changes in consumers’ behaviors, changes in urban and rural development, etc.

Territorial network in three points

– The territorial network plan or zoning research maps the catchment areas of a company’s future and current sales outlets.

Implemented at the start-up of the network, it is a decision-making tool that helps prioritize and optimize the development of new locations.

For example, the objective is to be able to reproduce the conditions of success, within the framework of the development of a franchise.

– It is necessary to renew this research every 3 to 5 years to consider the different evolutions of the territory and the socio-economic data and, of course, continue to ensure the geographical consistency of the network.

– A geomarketing application such as Symaps can be used to establish equivalent zones by combining the desired criteria (size, socio-demographic data, pedestrian and car traffic, competitive pressure, etc.).

Going Further

For existing networks, it is possible to refine projections by combining historical data on the performance of sales outlets or anonymized customer data with geolocation data.

Symaps’ geographic smart platform enables data enrichment to accurately estimate the potential of each area.

Share post